The Supermarket After the Pandemic

Brandon Hill’s parents met in the 1980s as common links in the rickety grocery-store supply chain. Both were packaged-goods wholesalers selling wares to the Price Chopper supermarket chain in Schenectady, New York. Hill’s mother trafficked in lunch meats; his father hawked aluminum foil. For a medium-size chain such as this, figuring out what to buy was a manual process. A couple of times a day in its stores, a floor worker would pull out a clipboard and walk the aisles. They’d look at how much Reynolds Wrap was left, or how many Oscar Mayer wieners, and mark it on paper. Then they would repeat that for every item in the store.

Thirty-five years later, many grocery stores still work the same way. Annually in America, “billions of dollars of food are transacted on sheets of matrix-printed paper,” says Hill, the CEO of the grocery-supply-chain-technology start-up Vori. A grocery store tends to get its goods from hundreds of separate vendors, many of which still communicate their offerings on printed catalogs dropped off by delivery workers or by sales reps such as Hill’s folks. Stock managers then can spend hours each week transmitting orders by phone or fax.

Attempts to automate this process have never quite panned out. As early as 1983, a computer program helped Price Chopper avoid accepting inventory it hadn’t actually ordered. Big operations such as Walmart have adopted sophisticated supply-chain-management systems, and Hill’s company assists smaller chains and their suppliers in doing the same. But the whole grocery business remains stubbornly resistant to automation and complete, digital tracking. Unless everybody uses the same tools, it’s back to the clipboard in the end. The largest stores stock up to 50,000 different items, all shifting constantly between shelves and carts, stockrooms and promotional endcaps, orange crates and produce-display piles.

This limitation has been a major factor in the slow growth of online grocery shopping. Last year, internet buying accounted for a tiny fraction of overall grocery sales. Online systems have trouble telling shoppers exactly what’s in stock, what looks fresh, what they might like, and what other options exist. Walmart is a $350 billion company, but no amount of money can determine whether an Instacart customer would prefer the six bone-in chicken thighs that are available to the four chicken breasts they requested. At some point, you simply have to go to the store.

[Read: Is it ethically okay to get food delivered right now?]

Except now that’s not so simple. Stay-at-home lockdowns of some kind have taken effect in 45 states and the District of Columbia because of the coronavirus. As a result, more Americans than ever before are ordering groceries online, either for delivery or pickup. Before COVID-19, Instacart, the biggest independent grocery-delivery service, had guessed that 20 percent of U.S. households would be shopping for groceries online in the next five years, a spokesperson for the company told me. But over the past month, “everything changed.” Its order volume is up 150 percent. New downloads of its app have multiplied sevenfold. In response, Instacart set out to hire 300,000 new “personal shoppers,” its name for the gig workers who pick and deliver groceries.

An awkward luxury service mere weeks ago, supermarket delivery has been forced into the mainstream so fast that stores and services are struggling to respond. Like Instacart, Amazon (which owns Whole Foods) can’t keep up with demand; according to one account, its grocery orders have risen 50-fold since the lockdowns began. The company is hiring 175,000 new delivery and operations personnel, but it has limited new grocery sign-ups until it can ramp up service. Some supermarket chains have already repurposed some of their interior space for online-grocery pickup, but many can’t keep up with the sudden demand, either. Walmart has extended store hours for pickup and delivery at some locations. Kroger closed at least one of its Ohio stores to the public entirely, reserving it for online-order fulfillment.

For years, the cumbersome grocery business has seemed a relic ripe for a Silicon Valley “disruption”—one that might erase and utterly remake supermarkets as we know them. In a way, the pandemic is that moment. When this all ends, it will have changed supermarkets forever. People will shop differently. Grocery workers’ jobs will shift. Stores will take on new shapes and sizes. But those changes won’t spell the end of supermarkets. Instead, they’re likely to tighten supermarkets’ grip on American life.

Like so many things that seem natural because they are familiar, the supermarket is an invention of about a century ago. It was “super” because it merged earlier, specialized markets, such as butcher shops, fishmongers, and greengrocers, into one much larger store. In 1916, Piggly Wiggly invented the self-service grocery, including all the trappings that characterize supermarkets such as Kroger and Safeway today: browsable aisles, shopping carts, price tags, and checkout lanes.

The American suburb cemented the supermarket’s reign in the 1950s, fueling more growth and bigger stores. Cars made carrying a week’s worth of goods back home possible, rather than a day’s. By the 1970s, the “superstore” made trips even bigger, begetting warehouses such as Walmart and Costco. Supermarket shopping became a staple of (gendered) middle-class identity, even as the middle class declined.

Online-grocery start-ups first aspired to overcome the chore of going food shopping in the late 1990s. Webvan and HomeGrocer.com raised hundreds of millions of dollars, but neither survived the dot-com crash. This gave other retail sectors a head start compared with grocery, which lost 10 to 20 years of progress in shifting habits toward internet ordering and delivery. Today, roughly half of book and music sales are made online, along with about 40 percent of consumer-electronics sales, 30 percent of apparel buying, and 20 percent of furniture purchases—but only 3 percent of grocery sales.

[Read: How you should get food during the pandemic]

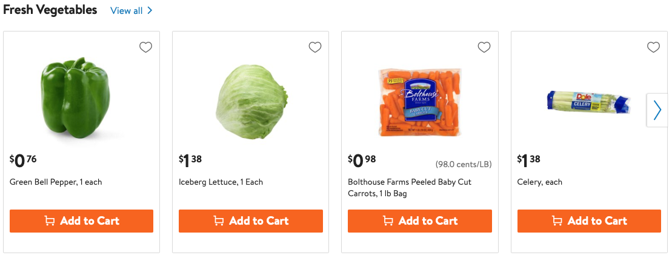

That hasn’t stopped supermarket chains and technology companies from forging ahead. Amazon Fresh, Walmart Grocery, and Instacart are now the biggest players, and almost every major chain now offers online ordering in some capacity, typically with a focus on store pickup instead of delivery. Even so, confining a row of fresh vegetables on Walmart Grocery to the same grid style Walmart.com uses to sell smartphone cases can look clinical and confusing, like an auto-parts catalog of a supermarket rather than a digital storefront for one. Food shoppers want to touch the avocados or shake the cantaloupes. Slicing the grocery store up into individual, pixelated goods doesn’t feel like grocery shopping anymore.

Behind the scenes, internet grocers don’t work like e-commerce, either. Online retailers ship from warehouses designed for rapid pick-and-pack. But grocery stores are designed around the psychology of shopping—browsing and impulse buying. The mismatch contributes to online grocery ordering’s current bottleneck. Supermarkets’ unwieldy supply-chain dynamics make it worse.

Taken together, these challenges can make online grocery shopping feel like more trouble than it’s worth. Once you select your products, the online grocers allow buyers to opt in to substitutions, in case a selected item is out of stock or otherwise unavailable. The process varies by service, with some recommending an alternative and others emboldening the hired runner to make a swap, which might or might not correspond to the customer’s preferences. Instacart’s software sometimes suggests exotic or perverse substitutions: printer paper for toilet paper, say. Social media is riddled with gripes about failures, including size variations in packaged goods and concerns about food allergies.

Add in the premium cost of pickup or delivery, the difficulty of returns, and the need to schedule online shopping at a time when you can be home to put the perishables away, and supermarkets exist out of harmony with technological life.

Grocers have changed before, however, and they can change again. Just as a new appetite for one-stop, self-service shopping led to supermarkets after the First World War, the pandemic could inaugurate a seismic shift in grocery shoppers’ habits. Right now, consumers are not dining out, because of lockdowns, but they still have to eat. Restaurant delivery is growing, but online grocery shopping—both delivery and pickup—is cheaper, reduces the number of trips that food workers have to make, and keeps shoppers out of stores, where personnel are at serious risk of infection. Fussiness also appears to be in decline. Supply crunches are making it hard to get certain staples, which could be inspiring a new tolerance for not getting exactly what you want—something close enough might be just fine.

[Read: Grocery stores are the coronavirus tipping point]

Lockdown is temporary, not a way of life. But it’s going to persist for some time, changing everyday practice along the way. Bryan Leach, the CEO of the digital-shopping-promotions company Ibotta, predicts that online grocery shopping will rise from 3 percent “into the double-digits” as a result of the pandemic. That’s a big change, but it would still see the majority of food shopping happen where it always has, in the stores. “I don’t think this is going to cause the death of the American grocery store,” Leach told me. “I still think people view it as the public square.” Shoppers won’t lose the ability to manipulate the avocados, pick something up on short notice, or just browse aimlessly for meal inspiration. But they might do so differently. A new attitude about supermarkets could change the way people approach food shopping in general.

This future might play out in both promising and worrying ways. On the promising side, more online food shopping could encourage companies to better remunerate grocery workers for their skills and persuade Americans to embrace smaller local supermarkets. Internet-grocery fetchers might come to be seen more as the small shopkeepers of the turn of the century, or the community-supported agriculture services that deliver fresh, local goods at small scales today: not menial laborers, but devoted workers with specialized knowledge and experience who help meet families’ specific food needs.

The shift to smaller-scale, more attentive grocery service has already taken place, in part. As superstores got bigger and consolidated more, they cleared room for shops intended for more specific markets. Those include Trader Joe’s and even Whole Foods, before Amazon bought it. Small butcher shops already had been enjoying a renaissance, and quarantine seems to be accelerating that trend. Those shifts are spurred, in part, by increased urban densification, along with the rising popularity of buying nonperishable consumer packaged goods, such as paper towels and crackers, from online services such as Amazon Pantry. If online grocery can supply the basics, that could be a boon for Main Street–style local shopping.

The worrying future is more likely, however. Big-box retailers could tighten their grip even further. Kroger’s and Amazon’s dedicated online-shopping stores are both experimental and temporary, but increased demand might justify such a solution on a larger scale—“dark stores,” a ghost-grocery equivalent of the ghost kitchen, a restaurant established solely for delivery. Ghost groceries could help the largest chains make online delivery run more efficiently, because the stores could be reorganized for order fulfillment rather than browsing. But dark stores would also help companies consolidate their share of the food business while expanding their stake in other sectors.

[Read: What you need to know about the coronavirus]

Supermarkets have always diversified as they have expanded. A big Kroger or Wegmans is almost like a town unto itself—inside you can find deli counters, bakeries, espresso cafés, juice stations, sushi bars. As Amazon, Instacart, and Walmart Grocery take over a sizable portion of weekly shopping trips, stores might shift the pick-and-pack effort to unseen storerooms on a permanent basis, repurposing the freed-up retail floor in new ways. Some already sell cookware, small appliances, and even apparel; others host complementary businesses such as Subway or LensCrafters. Some states have installed DMV desks or kiosks in grocery stores. Supermarkets could expand those offerings, transforming the superstore into the shopping mall’s successor. It’s not too hard to imagine popping into a Lululemon after picking up some flank steak and avocados for fajitas. (Over email, an Amazon spokesperson provided details about the company's strategies for dealing with demand during the pandemic, but declined to comment on its future ambitions. Walmart did not respond to a request for comment.)

The supermarket was already taking over America’s commercial retail sector, slowly and invisibly, long before the internet. The largest superstores represent long-term investments that bear dividends over decades. Walmart often owns its real estate, or even leases it from itself, reportedly to take advantage of tax loopholes. And unlike America’s dying shopping malls, supermarkets blanket cities, suburbs, and rural areas alike. A new superstore frequently anchors a large shopping center, and Walmart sometimes develops the land around its stores as a diversification strategy and to protect its brand image by controlling nearby storefronts.

The coronavirus is accelerating that growth. After mortgage banks and landlords, the $1,200 stimulus checks many Americans are receiving will likely be sent right back to Amazon, Walmart, Costco, and Kroger. That might crush the small and medium-size grocers that Brandon Hill, the grocery-logistics-software founder, hopes his technology might benefit, even if his software could help keep their workers safer by getting them off the retail floor. And if those stores go under, their bigger competitors could easily scoop them up for conversion into ghost groceries.

An expansion of superstores would impact supermarket workers and low-income shoppers most. The dream that companies might come to value their shopper employees as experts is probably a fantasy. When I asked Instacart to describe its future vision for its “personal shoppers,” the company fell back on venture-funded gig-work platitudes: “It’s an immediate, flexible earnings opportunity that allows individuals to earn when and how they want.” Meanwhile, those very shoppers staged a walkout in late March, demanding hazard pay and better protective equipment. The company responded with some new policies, including safety kits, sick pay, and pandemic bonuses. A representative told me that the strike has caused “absolutely no impact to Instacart’s operations.” Instead, 250,000 new people signed up to become shoppers during the first week of April, many of whom might have recently lost full-time employment because of the pandemic.

Despite their meteoric rise during the crisis, online grocery services are still largely for rich people. Placing huge orders meant to last weeks or months is great for families who can afford to do so, but for those living paycheck to paycheck, more delivery orders would just mean more service fees and tips to cover. A recent industry survey found that an inability to use coupons stymied 68 percent of online grocery shoppers. The USDA is running a pilot program to allow grocery buyers on public assistance to buy groceries online, but it hasn’t rolled out everywhere and it doesn’t work with all chains or every service.

[Read: How panic-buying revealed the problem with the modern world]

The big grocery chains and consumer packaged-goods companies are best positioned to solve those problems, but they might choose to look after their own fortunes first. Walmart and others have circled the wagons to combat a huge increase in fees for accepting Visa’s credit cards; among other strategies, Leach surmises that retailers might adopt closed-loop rewards systems, such as offering cash-back credits redeemable only at their own stores. That might offset grocery delivery fees, which would be good for consumers. But it would also entrench big chains’ advantage against smaller stores. Even today, Walmart is already getting more than half of new online grocery customers.

Leach told me that the big consumer packaged-goods brands would much rather spend their marketing dollars pressing customers to add their products to online grocery-shopping baskets than invest in ads on television or Facebook. That’s because online shopping can guarantee sales performance: Many of the services allow customers to repeat a previous order with a single click. Once Procter & Gamble gets Charmin in your regular order, it’s unlikely to come out again. “There’s a fierce death match to get in the basket,” Leach said. That adds convenience, but it also risks luring shoppers into blindly subscribing to bundles of consumer goods as they do to Netflix and other streaming services.

When the dust settles and Americans can transit their towns again without worry, supermarkets will still be nestled in their wide parking lots. People will still have to set aside time to shop, although they might do so more often with smartphones instead of carts. Someone might drop staples right at your door regularly, just as the milkman, breadman, and eggman once did. Superstores will probably vacuum up more businesses that used to exist only outside them, just as they did with the butcher and the pharmacy, the lunch counter and the coffeehouse.

For a hundred years, the grocery business has burgeoned through consolidation and expansion. Neither technological advancements nor a global pandemic is likely to stop that train. “A mammoth industry rises up with the dew in the morning,” Hill says wistfully of his family’s trade. After the plague, that industry will be even more colossal. Its small shops and workers may suffer. Its big companies may triumph. And Americans will keep shopping, as they always have.

Read full news

No comments